*Disclosure: This blog applies for United States taxes and laws only. Also, everyone’s tax situation is different. Consult with a tax professional/accountant.

The end of the year is here and with that, usually comes some last-minute planning.

I’ve noticed that there has been some confusion on a few things, such as if wash sale rules apply, if you can net crypto losses against other investment gains and more.

Thanks to a recent IRS revenue ruling (Rev. Rul. 2019-24) and a new FAQ, we did get some clarity on a few things.

In this article, I am going to go through some key points on cryptocurrency that may help you going into the end of the tax year when working with your accountant.

Crypto Investors and the Wash Sale Rule

A wash sale occurs when you sell a security for a loss, then continue to re-purchase that same security within 30 days before or after the day you sold it .

The purpose of selling for a loss to just buy back shares right afterward is to harvest a loss for tax saving purposes.

The wash sale rules were created to discourage people from selling securities, just to generate a tax benefit.

If your transactions are in fact considered a wash sale, the IRS will not allow you to use the loss to reduce your gains. Instead, they will make you add your loss to your cost basis of the new security (your holding period also carries over which is important if you’re trying to hold for long term capital gains).

There seems to be some confusion not only among investors but also some accountants on if the wash sale rule applies to cryptocurrencies.

Rightfully so, as we have to essentially navigate what the Security Exchange Commission defines as a security, and rummage through the IRS code at the same time.

The consensus among tax and planning professionals is that the tax code for wash sales only speaks to “stock or securities”.

[If you’re looking for a read to put you to sleep, you can actually read the IRS publication 550 yourself under the “Wash Sales” section]

So, this begs the question, which cryptocurrencies do the SEC consider as “securities”?

The question of if cryptocurrencies are a security seems to come with some blurred lines.

The SEC chairman during an interview with CNBC mentioned :

“Cryptocurrencies: These are replacements for sovereign currencies, replace the dollar, the euro, the yen with bitcoin,” Clayton said. “That type of currency is not a security.”

However, the chairman continued to discuss how Initial Coin Offerings could be securities if they’re being offered to investors in exchange for “performance” or “profit” of some kind.

The Howey test is used to essentially determine if something is a security and therefore should be governed by the SEC and subject to the wash sale rules.

Taken from the SEC website: “Usually, the main issue in analyzing a digital asset under the Howey test is whether a purchaser has a reasonable expectation of profits (or other financial returns) derived from the efforts of others.”

Essentially, if a third party is benefiting in some way (e.g. the coin offeror), it could be regulated under the SEC as a security. On the other hand, a crypto such as Bitcoin, is a currency with no real 3rd party benefit.

So, with that said, as far as wash sale rules go, for now, it seems to be that a cryptocurrency such as Bitcoin will not be subject to any wash sale rules per the definition of a security as well as the IRS code.

However, something such as an ICO could be a blurry line. I suggest talking with an accountant about it if you’re unsure.

I wouldn’t be surprised if in the future, we get more clarification when it comes to wash sales on:

1. ICO’s or other security tokens

2. Bitcoin and other digital currencies that don’t pass the Howey test

Hello, Specific Lot Identification

One of the things that came from the newest IRS revenue ruling, was that people may use an alternative to FIFO when reporting gains/losses.

FIFO means “first-in-first-out”. So, when you sell a coin, the IRS wanted you to use the cost basis of your very first coin to determine your gain/loss.

This can be unadvantageous if you’re sitting on some large gains (hence a big tax bill).

Now, the IRS is saying that you have an additional option called specific lot identification.

If you can determine which coin you are selling, you have the option to choose to sell the coin that you wish, which could essentially mean you’re selling a coin with a higher cost basis, lowering your tax bill.

“A39. You may identify a specific unit of virtual currency either by documenting the specific unit’s unique digital identifier such as a private key, public key, and address, or by records showing the transaction information for all units of a specific virtual currency, such as Bitcoin, held in a single account, wallet, or address. This information must show (1) the date and time each unit was acquired, (2) your basis and the fair market value of each unit at the time it was acquired, (3) the date and time each unit was sold, exchanged, or otherwise disposed of, and (4) the fair market value of each unit when sold, exchanged, or disposed of, and the amount of money or the value of property received for each unit.”

Offsetting Gains with Cryptocurrency Losses

There was also some confusion from many investors if they’re able to net crypto losses against other gains in securities. Or even vice versa.

The answer here is yes, you may.

Cryptocurrency is considered property by the IRS, so property rules apply.

This means that cryptocurrency is a capital asset and can produce capital gains/losses.

Other types of capital assets are stocks/bonds, your home, jewelry, gold and more.

Of course, the “1 year plus a day” holding period still applies to be able to take advantage of preferential capital gains rates.

If you didn’t hold the asset for a year, then that is considered a short term gain and it’s treated as ordinary income (short-term).

You’re able to net short term gains/losses against long term ones. As far as claiming a capital loss after netting everything properly (yes, there is an ordering that the IRS wants you to follow), the IRS caps your claimable loss at $3,000 per year.

You’re able to carry forward whatever amount above your $3,000 limit.

The IRS Gets Nosy

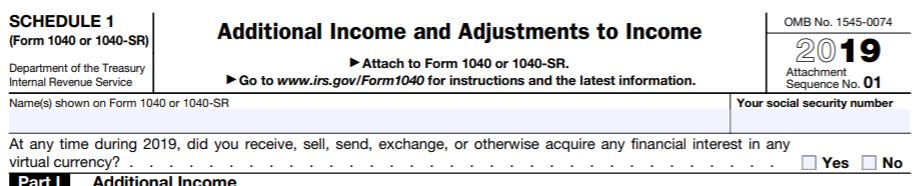

Get prepared for a new question that has been officially published for the 2019 Form 1040 Schedule 1 forms:

It’s important to know that this question is going to come your way so that you can get all of your documents in order for the 2019 tax season.

I’ve talked about this form before when it was in draft, but they pulled the trigger on it.

The one thing that might be seen as a positive within the crypto community with this, is that the IRS doesn’t see crypto going away anytime soon…