Millennial’s tend to get a bad reputation.

We spend more money on avocado toast than we should (rightfully so, as it’s delicious). We also get told we job hop too much and we’re entitled.

The worst reputation of all though is that millennials are afraid to invest in the stock market.

So afraid, that according to the St. Louis Federal Reserve, 3 in 5 millennials don’t have investing exposure in the stock market.

Millennials are great savers but prefer investing in money market funds, bonds and CD’s.

It’s certainly good to utilize these investments for a portion of your assets.

The issue with having all of your eggs in this basket, is that the returns on conservative investments like these may not help you reach your retirement funding goals.

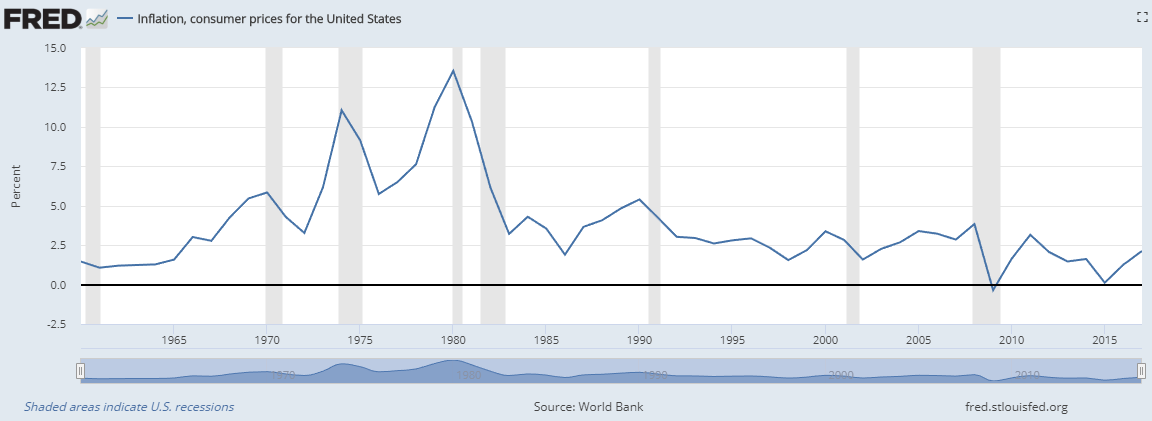

Inflation Eats Your Money Over Time

Most millennials really like keeping their money safe, but unfortunately, 100% safe may not generate true wealth.

Notice how you can’t get out of the grocery store these days without dropping $100 bucks? It feels like your money gets you less.

Turns out you’re not crazy, your money is buying you less.

This my friends, is inflation at work!

Inflation makes everything more expensive over time. As prices inflate, it reduces your purchasing power for goods.

With inflation averaging over time around 2-3% a year, you basically have to imagine that your money is decreasing by that amount every year.

Most people don’t think to look at it that way, and that is part of the issue.

Mathematically, it’s difficult to exponentially grow your money after inflation when you’re only earning about 3% a year (3% is roughly the current yield on safer investments).

After you account for inflation, let us assume 2% to be nice, you’re really only earning 1% a year on your money (aka your “real return”).

1% is better than nothing, but the question to ask yourself is “Will this help me reach my retirement goals?”

Now, interest rates being so low for so long after the 2008 financial crisis has made it very hard to earn a high return with low risk investing.

This can change in the future and you may be able to get more yield (aka bang for your buck) down the road, but right now this is our reality and my examples will be based on that.

Here is the data showing historical inflation to give you some context:

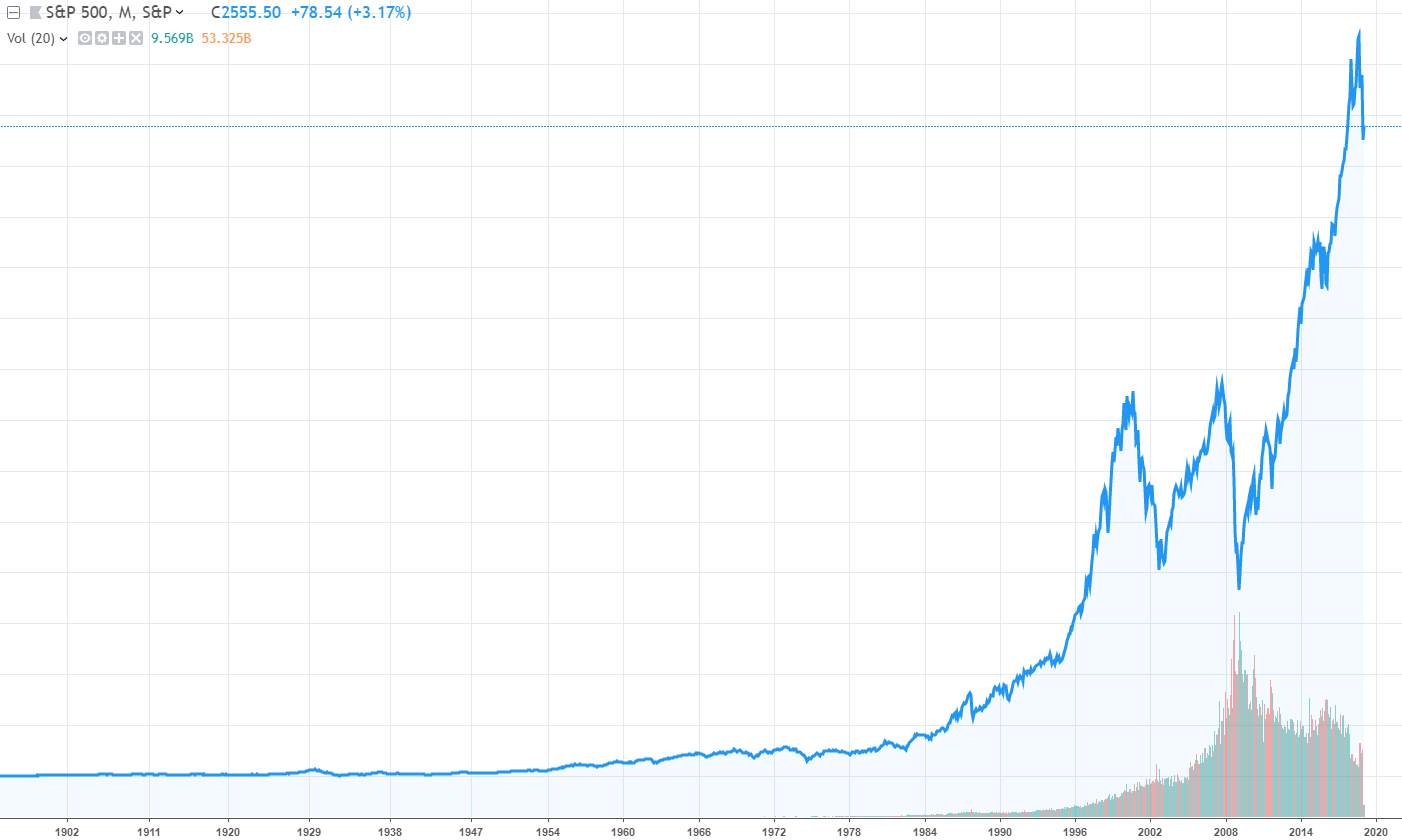

The Greatest Wealth Generator

The stock market has been around for hundreds of years, and it has made a lot of people a lot of money.

This didn’t come without taking some risk and even losses, but there are ways to diversify a portfolio and protect yourself.

Some examples of lower risk investments that may yield you higher returns in both the stock and bond markets would be: investing in solid companies that pay dividends, using a variable annuity or investing in municipal bonds.

We have to objectively look at what the stock market has done historically to really grasp the concept of why it has been the best way to build wealth over time.

Here is a chart of how the stock market has appreciated:

It’s pretty impressive, to say the least…and scary for many at the same time.

Many people are waiting for a huge stock market crash again.

What you’re not hearing a lot of, is how great of an opportunity it would be to be able to purchase the stock market cheaper.

Those that have been scared to invest from 2008’s financial meltdown, missed the biggest bull run in history.

So, it’s important to realize that you will invest over time at higher and lower prices that will average out.

So instead of avoiding it, look forward to the good times and the bad (because you can actually benefit from both).

Even through the bear markets (crashes in price), the market was able to come back to recover even stronger.

Past performance doesn’t predict future performance, but the idea when you’re younger is to invest in the stock market and hold your investments for a long period of time.

The good news is, it’s not too late for millennials.

This is how true wealth is grown, by being patient and allowing your investments to compound over time.

The average real return in the stock market (after inflation) is around 7% a year.

So, investing in the stock market offers roughly 6% more a year than what most millennials are likely currently doing with low-risk investments as described earlier.

A general rule of thumb is to save 10% of your pre-tax income for retirement.

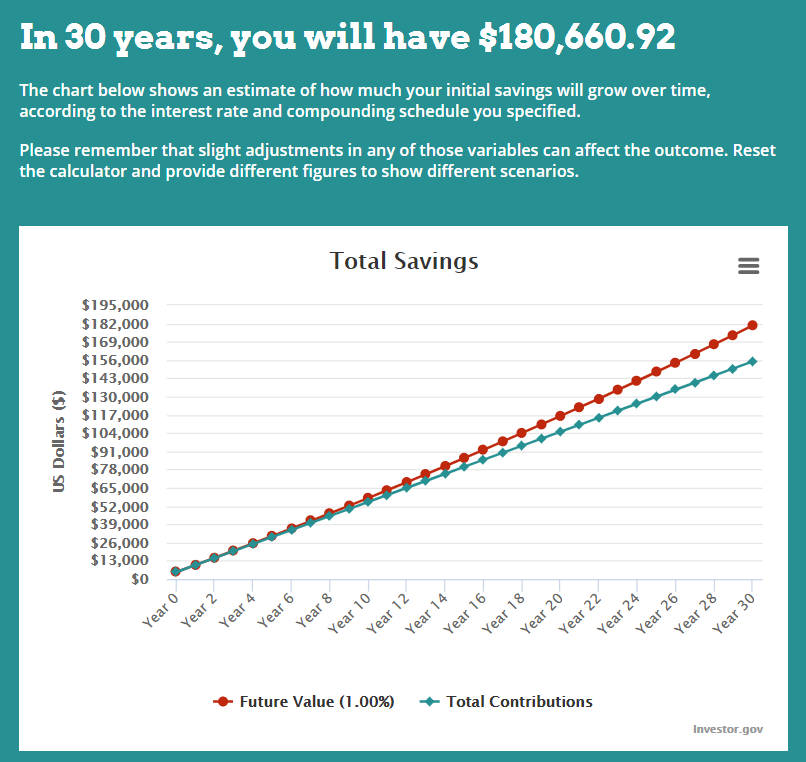

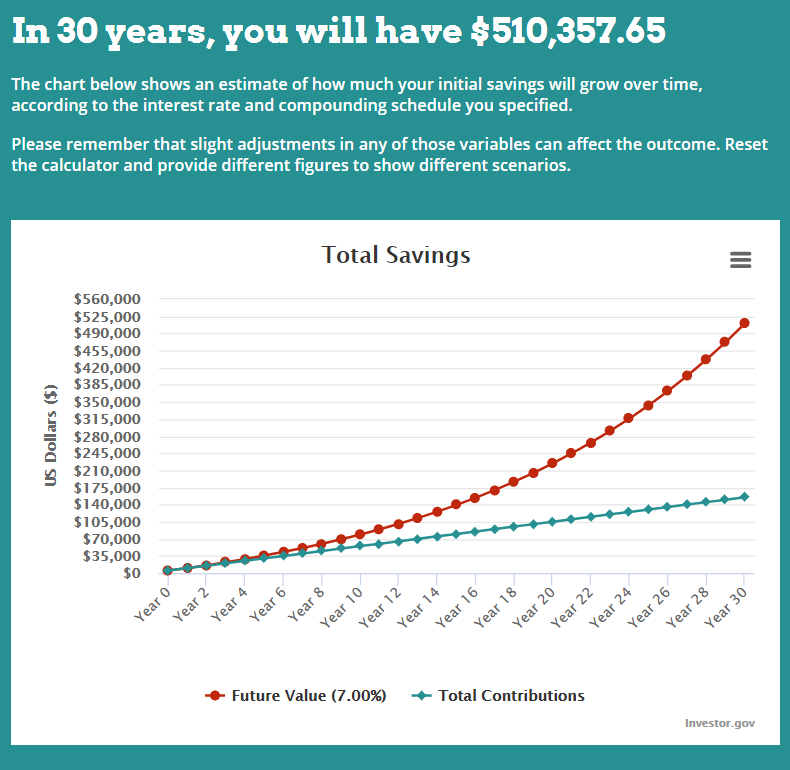

With that said, I want to do an example comparison for you of what returns are on conservative investments vs. the stock market after inflation.

For a comparison example, I’m basing this off of a $50,000 salary and the following metrics: 1. You start with $5000 (10% of your pre-tax income) 2. You continue to contribute $5000 every year for 30 years.

Conservative Investments Netting 1% Return (3% return less 2% inflation = 1%)

Stock Market Investments Netting 7% Return After Inflation

Keep in mind, your salary will likely increase over time, and I know you may not be able to save 10% of your income for retirement, but I just want to keep it simple for this example.

Hopefully, you can see what I mean by “exponentially” growing your money, now.

It simply can’t grow as fast with a low rate of return and it may not be able to provide you the funds that you need for your golden years.

Now, take it a step further and imagine if your employer will match your retirement contributions (they usually do this up to a certain % of your income). That money being added with a match will help it grow even MORE.

So, I stress to you, if you can afford to max out your contribution to get the max match, please do.

Risk Tolerance

Obviously, there are many variables to this investing game. Everyone’s situation is going to be different.

These factors include your age, your salary, your retirement goals, and your risk tolerance.

You can diversify though, and have only a certain percentage of your assets in the stock market while investing the rest in safer bonds or many other types of assets.

A happy medium can exist to match your risk tolerance.

There is a general rule of thumb called the 100 rule.

You subtract your age from 100 to determine what percentage of your portfolio should be invested in stocks vs. bonds.

For example, someone who is 30 years old, would want a portfolio of about 70% stocks and 30% bonds.

This is a very general rule of thumb that may not work for your specific risk tolerance, but it serves as a good guide to see where you stand.

If the “rule” states you should be 70% in stocks and the thought of that makes you nauseous, you can adjust until you feel comfortable.

It may be hard to envision retirement so early in life, but to figure out where you need to be, it’s not a bad idea to journal what you want your retirement to look like.

Do you want to have your house paid off and live in it? Prefer to travel? Prefer to go to a low-maintenance condo retirement community? How much will your lifestyle cost you every year?

What you think you want now will change as you age, so it’s good to continue to update your “plan” as you go.

The internet makes thinking about retirement even easier with nifty retirement calculators.

You can use one of these calculators to get an idea of how much you should be saving to reach your goals.

Even if you’re a bit behind now, the first step is realizing that this is something you should have more at the forefront of your mind.

Maybe you realize that you should look at the stock market a little closer.

Knowledge is power as they say. But, compounding interest is power, too.

Looking to learn more about trading and investing in the stock market? Join our community of like-minded investors, entrepreneurs and expert mentors.